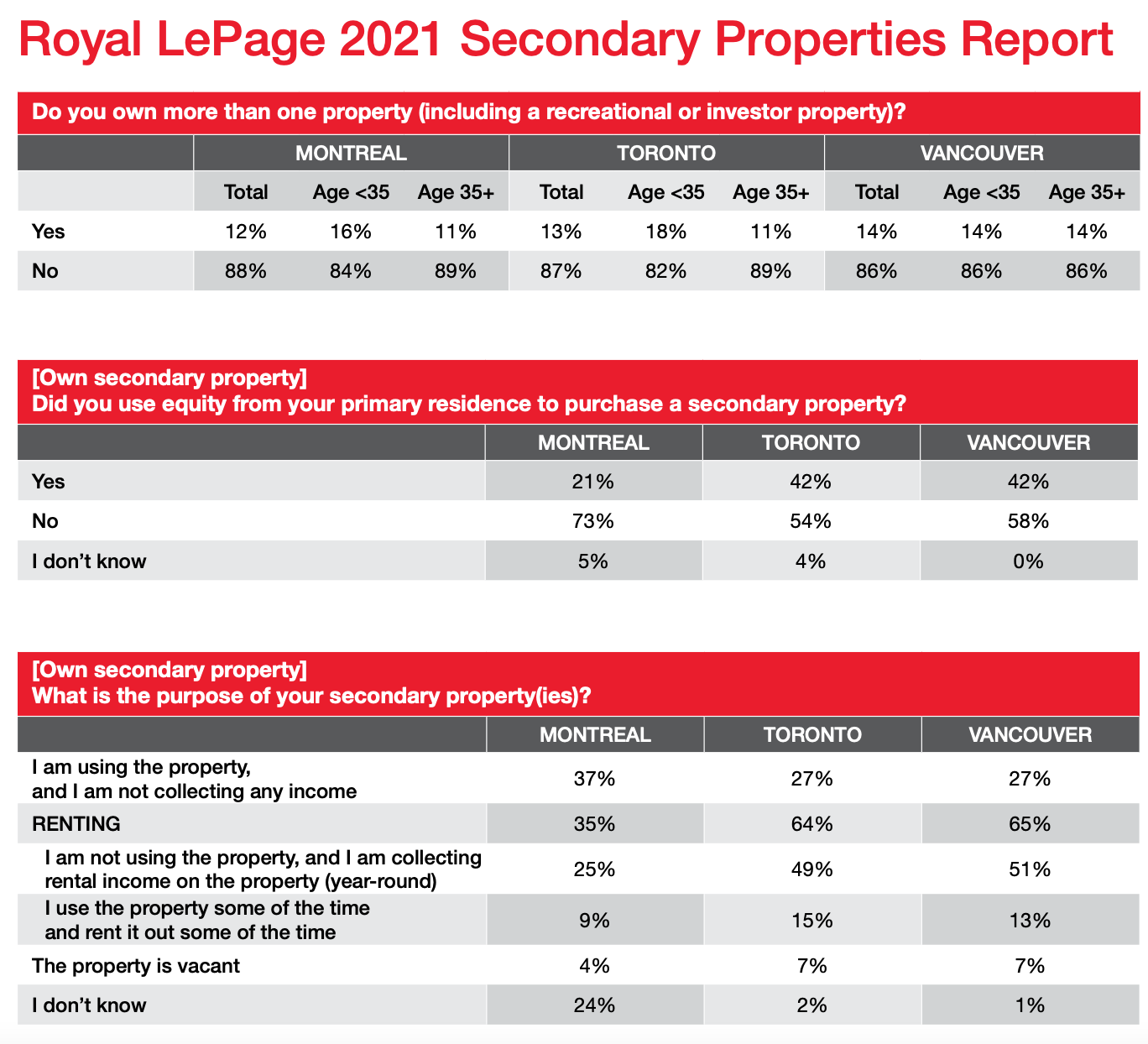

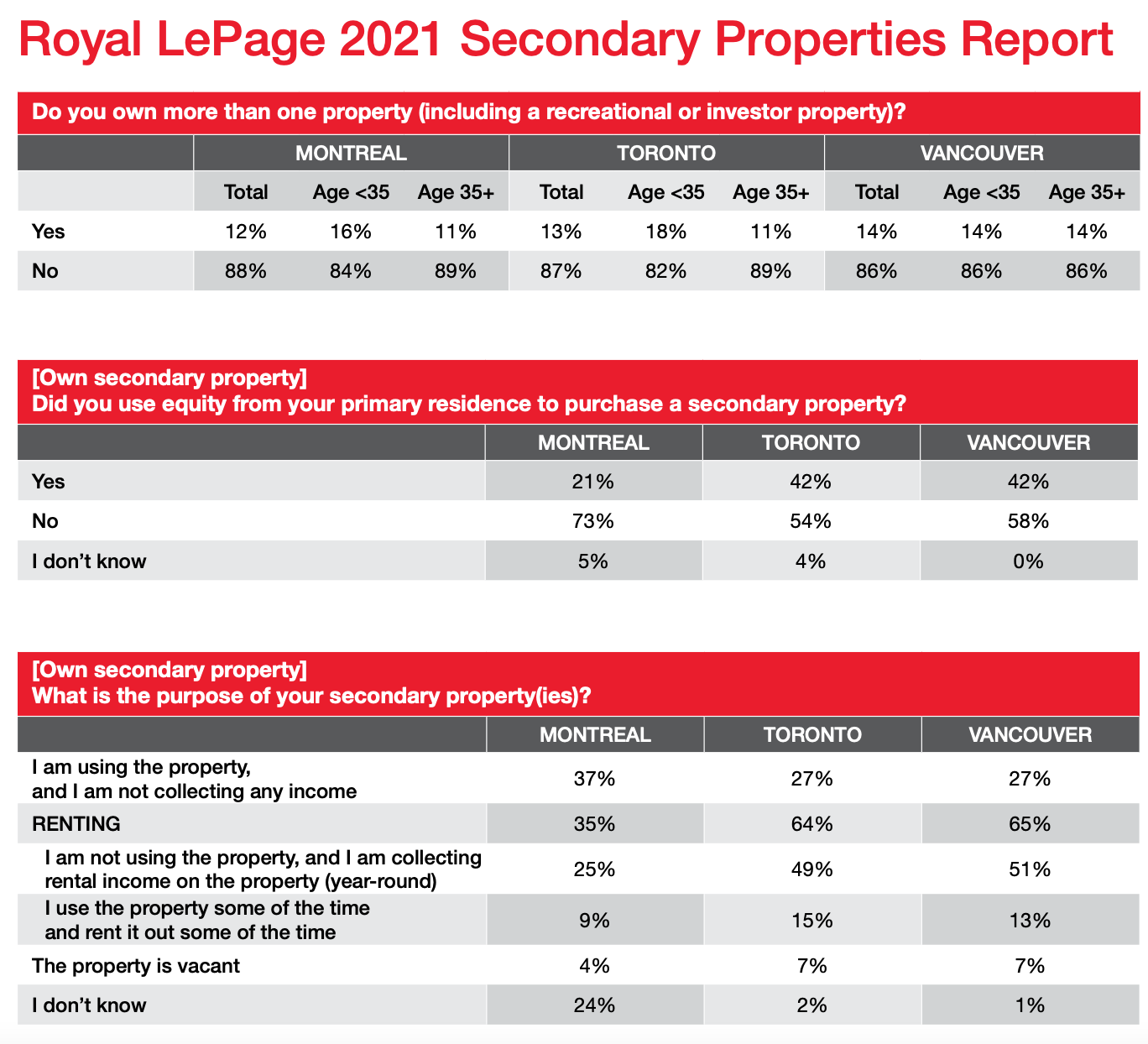

You may be surprised to know that more than one in ten homeowners in Canada’s three largest urban centres – the greater regions of Toronto, Montreal and Vancouver – currently owns multiple properties. A recent Royal LePage survey, conducted by Leger, found that 14% of homeowners in Greater Vancouver own more than property. Similarly, 13% of homeowners in the Greater Toronto Area and 12% in the Greater Montreal Area own multiple properties.

While rapid home price appreciation can be challenging for potential buyers, as we’ve seen over the last year and a half, homeowners have taken advantage of the growing equity in their properties. Of secondary property owners in the Toronto and Vancouver areas, 42% said they used equity from their primary residences to purchase a secondary unit. Meanwhile, in the Greater Montreal Area, where home prices are more affordable, that number drops to 21%.

What’s more, secondary property owners in Toronto and Vancouver are more likely to use the residence as an investment, collecting income on the property at least some of the time. More than two thirds of respondents in Greater Vancouver (65%) and the Greater Toronto Area (64%) said they were collecting rental income on their secondary properties, if only some of the time. In the Greater Montreal Area, that number decreased to 35%.

“While some secondary properties are used for recreational purposes, many of these homes are foundational to Canada’s critical supply of rental housing,” said Phil Soper, president and CEO, Royal LePage. “Entrepreneurial landlords supply housing to the thirty per cent of Canadians who rent, be they new immigrants, students, young people entering the labour force or those who cannot or choose not to own their home.”

In Greater Vancouver, 27% of secondary property owners said they were not collecting any rental income at all, while 51% said they are using the unit solely as a rental property. 13% said they were using the property some of the time and renting it out some of the time. 7% of respondents said their secondary properties are currently vacant.

“Real estate is an integral part of retirement planning for many Vancouver homeowners,” said Caroline Baile, real estate broker, Royal LePage Sussex. “While some are using their secondary properties, possibly a cottage or a ski chalet, many of those with multiple homes are looking to build future equity as a means of sustaining a desired lifestyle down the road. Investment properties are not likely being used to subsidize monthly income, but are seen as a long-term investment.”

In Greater Vancouver, the country’s most expensive city to buy real estate, 14% of homeowners aged 18 to 35 currently own more than one property. Similarly, 14% of homeowners over the age of 35 own more than one property.

“Younger Canadians are sitting in the driver’s seat of their own futures. They are very business savvy, and have a clear idea of what they want their retirement years to look like. Young people today put a lot of emphasis on work-life balance. They want their money to work for them, and they recognize that investing in real estate has the potential for great returns,” continued Baile. “While so many young Canadians struggle to enter the real estate market, those fortunate enough to do so, whether on their own or with financial support from their parents, will reap the benefits in the future.”

Meanwhile, in the Greater Toronto Area, 27% of secondary property owners are using the home, likely for recreational purposes, while 49% have their secondary unit rented out full-time, and 15% are using the property some of the time and renting it out some of the time.

While rapid home price appreciation can be challenging for potential buyers, as we’ve seen over the last year and a half, homeowners have taken advantage of the growing equity in their properties. Of secondary property owners in the Toronto and Vancouver areas, 42% said they used equity from their primary residences to purchase a secondary unit. Meanwhile, in the Greater Montreal Area, where home prices are more affordable, that number drops to 21%.

What’s more, secondary property owners in Toronto and Vancouver are more likely to use the residence as an investment, collecting income on the property at least some of the time. More than two thirds of respondents in Greater Vancouver (65%) and the Greater Toronto Area (64%) said they were collecting rental income on their secondary properties, if only some of the time. In the Greater Montreal Area, that number decreased to 35%.

“While some secondary properties are used for recreational purposes, many of these homes are foundational to Canada’s critical supply of rental housing,” said Phil Soper, president and CEO, Royal LePage. “Entrepreneurial landlords supply housing to the thirty per cent of Canadians who rent, be they new immigrants, students, young people entering the labour force or those who cannot or choose not to own their home.”

In Greater Vancouver, 27% of secondary property owners said they were not collecting any rental income at all, while 51% said they are using the unit solely as a rental property. 13% said they were using the property some of the time and renting it out some of the time. 7% of respondents said their secondary properties are currently vacant.

“Real estate is an integral part of retirement planning for many Vancouver homeowners,” said Caroline Baile, real estate broker, Royal LePage Sussex. “While some are using their secondary properties, possibly a cottage or a ski chalet, many of those with multiple homes are looking to build future equity as a means of sustaining a desired lifestyle down the road. Investment properties are not likely being used to subsidize monthly income, but are seen as a long-term investment.”

In Greater Vancouver, the country’s most expensive city to buy real estate, 14% of homeowners aged 18 to 35 currently own more than one property. Similarly, 14% of homeowners over the age of 35 own more than one property.

“Younger Canadians are sitting in the driver’s seat of their own futures. They are very business savvy, and have a clear idea of what they want their retirement years to look like. Young people today put a lot of emphasis on work-life balance. They want their money to work for them, and they recognize that investing in real estate has the potential for great returns,” continued Baile. “While so many young Canadians struggle to enter the real estate market, those fortunate enough to do so, whether on their own or with financial support from their parents, will reap the benefits in the future.”

Meanwhile, in the Greater Toronto Area, 27% of secondary property owners are using the home, likely for recreational purposes, while 49% have their secondary unit rented out full-time, and 15% are using the property some of the time and renting it out some of the time.

“Canadian homeowners believe in the value of real estate because they have seen their investments grow over time,” said Karen Millar, sales representative, Royal LePage Signature Realty. “People feel confident investing in real estate because it is a physical entity that they can experience. Although the market may see peaks and valleys, homes have historically generated wealth in the long run.”

In the Greater Montreal Area, 37% of secondary property owners are using the home, likely for recreational purposes, while only 25% have their secondary unit rented out full-time, and 9% are using the property some of the time and renting it out some of the time.

“Among secondary property owners in Montreal, the majority are using the properties for leisure, like recreational purposes, rather than as an investment,” said Roseline Guèvremont, real estate broker, Royal LePage Tendance. “Although the real estate market has begun to catch up in recent years, prices remain considerably more affordable, so buyers can purchase without necessarily leveraging equity from a primary residence.”

The Royal LePage 2021 Secondary Properties Report includes regional data for the greater Toronto, Montreal and Vancouver areas.

“Among secondary property owners in Montreal, the majority are using the properties for leisure, like recreational purposes, rather than as an investment,” said Roseline Guèvremont, real estate broker, Royal LePage Tendance. “Although the real estate market has begun to catch up in recent years, prices remain considerably more affordable, so buyers can purchase without necessarily leveraging equity from a primary residence.”

The Royal LePage 2021 Secondary Properties Report includes regional data for the greater Toronto, Montreal and Vancouver areas.