The Sunshine Coast real estate market closed 2025 in a different position than many urban centres across British Columbia — but not because it avoided change. After a rapid run-up during the pandemic years, the Sunshine Coast experienced a noticeable price decline earlier than Metro Vancouver, with most of that adjustment taking place between mid-2022 and 2023.

By 2025, prices had largely settled at lower levels and were no longer moving sharply in either direction. That does not mean the market is immune to further change. As a feeder market to Metro Vancouver, the Sunshine Coast remains closely tied to buyer equity, sale timelines, and confidence in the Lower Mainland. When homes in Vancouver take longer to sell or sell for less, buyers coming to the Coast often have less money to work with and take longer to make decisions.

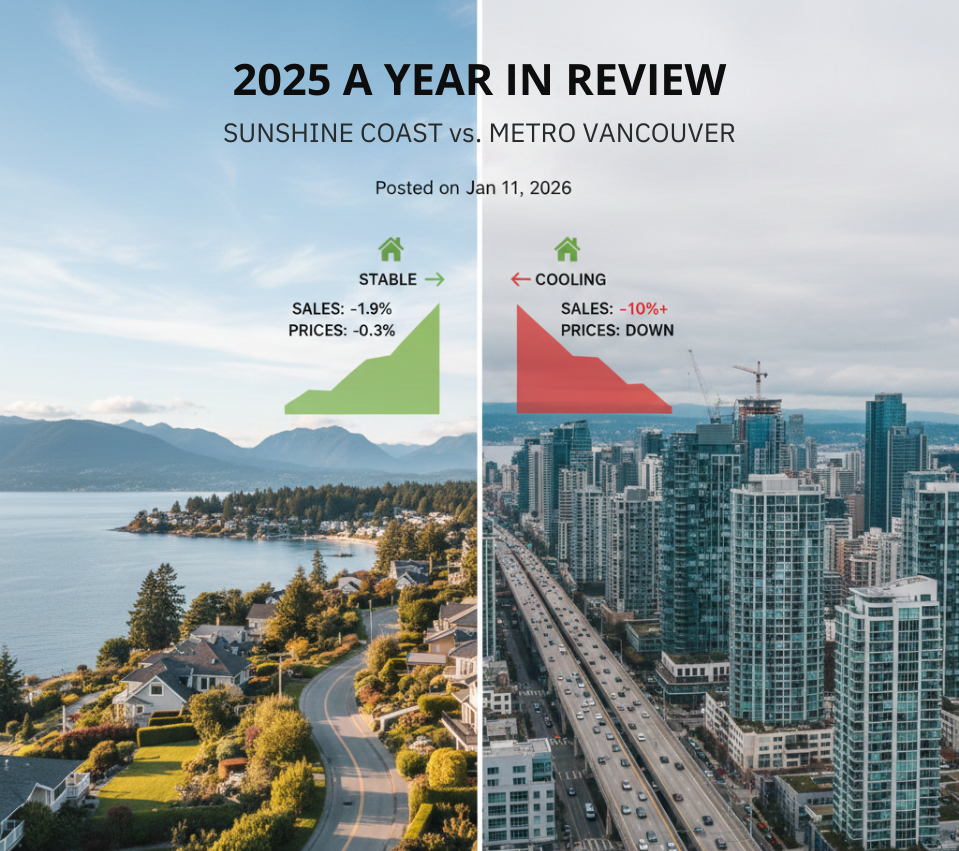

This review compares Sunshine Coast performance directly with Metro Vancouver and looks at how economic conditions, mortgage renewals, and broader uncertainty shaped the market over the past year. It also provides a detailed breakdown of sales by property type and area.

Sunshine Coast vs. Metro Vancouver: Different Timing, Connected Markets

Metro Vancouver ended 2025 with approximately 23,800 residential sales, down more than 10% year over year and nearly 25% below its 10-year annual average. Inventory continued to build, giving buyers more choice and more negotiating power. Higher borrowing costs, affordability challenges and changes to short term rentals remained a major drag on activity, particularly in higher-density housing.

On the Sunshine Coast, 621 residential properties sold in 2025, compared to 633 in 2024. Total dollar volume declined modestly to $595.1 million, down from $608.3 million the year before. The average sale price remained largely unchanged at $958,305, compared to $960,974 in 2024.

While average prices appeared stable year over year, this followed a meaningful price drop that occurred earlier. Based on MLS® HPI benchmark data, Sunshine Coast prices peaked around May 2022 at approximately $959,600. From mid-2022 through 2023, benchmark prices fell by roughly 17%. By December 2024, the HPI sat near $798,000, and by December 2025, approximately $792,700, showing that prices edged slightly lower but did not fall sharply again.

This difference in timing matters. The Sunshine Coast went through its price decline earlier and more quickly. Metro Vancouver’s adjustment has been slower and is still playing out, with inventory and affordability pressures continuing into 2025.

Because many Sunshine Coast buyers rely on selling a home in Metro Vancouver first, local demand remains sensitive to what happens there. When Vancouver homes take longer to sell or achieve lower prices, buyers on the Coast often delay purchases, make more conditional offers, or adjust what they can afford.

Sunshine Coast Market Overview: Sales and Pricing

The small decline in Sunshine Coast sales and dollar volume in 2025 reflects a market that has slowed and become more cautious, rather than one that is falling rapidly. Inventory levels meant buyers had more choice, took more time, and were more careful about pricing, condition, and location.

Throughout 2025, successful sales were more likely when properties were priced realistically and well prepared. Overpricing and renovation uncertainty were more likely to result in longer time on market.

Performance by Property Type

Detached Homes

Detached homes continued to make up the largest share of Sunshine Coast sales. This segment also saw the greatest adjustment, as buyers were more cautious about higher price points and renovation costs.

Detached Home Sales — Sunshine Coast

- 2024: 455 sales

- 2025: 430 sales

- Year-over-year change: −25 sales (−5.5%)

Detached Sales by Area (2025 price ranges):

- Sechelt District: 155 sales | $460,000 – $3,050,000

- Gibsons & Area: 135 sales | $505,000 – $4,200,000

- Halfmoon Bay: 50 sales | $735,000 – $3,200,000

- Pender Harbour / Egmont: 45 sales | $615,000 – $2,500,000

- Roberts Creek: 38 sales | $910,000 – $4,100,000

Well-located and well-maintained homes continued to sell, while properties requiring significant updates or priced above comparable sales often took longer.

Townhomes & Attached Homes

Attached homes were the most stable part of the Sunshine Coast market in 2025. Demand was supported by downsizers, affordability limits, and a lack of new supply.

Attached Home Sales — Sunshine Coast

- 2024: 120 sales

- 2025: 125 sales

- Year-over-year change: +5 sales (+4.2%)

Attached Sales by Area:

- Sechelt District: 65 sales | $455,000 – $900,000

- Gibsons & Area: 55 sales | $510,000 – $1,000,000

Sales volumes in other areas were too small for meaningful comparison.

Condominiums

Condominium demand remained steady in 2025, particularly among retirees and full-time residents. The modest decline in sales was mainly due to limited supply rather than reduced interest.

Condominium Sales — Sunshine Coast

- 2024: 65 sales

- 2025: 60 sales

- Year-over-year change: −5 sales (−7.7%)

Condominium Sales by Area:

- Sechelt District: 32 sales | $405,000 – $700,000

- Gibsons & Area: 28 sales | $450,000 – $750,000

Land

Land experienced the sharpest pullback of all property types in 2025. Higher construction costs, longer build timelines, financing challenges, and uncertainty reduced speculative buying.

Land Sales — Sunshine Coast

- 2024: 75 sales

- 2025: 60 sales

- Year-over-year change: −15 sales (−20.0%)

Land Sales by Area:

- Sechelt District: 25 sales | $250,000 – $1,200,000

- Gibsons & Area: 20 sales | $300,000 – $1,500,000

- Pender Harbour / Egmont: 10 sales

- Halfmoon Bay: 5 sales

Broader Economic and Political Factors

Mortgage renewals from loans taken out during the very low interest rate period of 2020–2022 continued to influence decisions in 2025. Higher renewal rates affected affordability and contributed to more cautious buying and selling behaviour.

Political and trade uncertainty in the United States also added to broader market hesitation. While these factors tend to affect large urban markets first, they also influence confidence and timing in secondary markets like the Sunshine Coast.

Final Thoughts on 2025

The Sunshine Coast did not avoid a market downturn — it experienced one earlier than many urban centres. By 2025, prices had already adjusted downward and were no longer moving as sharply. However, the market remains sensitive to what happens in Metro Vancouver, where longer selling times and softer pricing can reduce buyer purchasing power locally.

As conditions continue to evolve, realistic pricing, strong presentation, and patience remain critical. Buyers and sellers alike are making decisions more carefully, and outcomes are increasingly shaped by fundamentals rather than momentum.

Data Disclaimer

Sales figures are based on MLS®-reported Sunshine Coast residential transactions for 2024 and 2025. Property classifications reflect how listings were categorized at the time of sale. MLS® HPI figures reflect benchmark pricing at year-end (December), not annual averages. In limited cases, classification differences may result in minor variances when aggregating data by product type or sub-area.

Sales figures are based on MLS®-reported Sunshine Coast residential transactions for 2024 and 2025. Property classifications reflect how listings were categorized at the time of sale. MLS® HPI figures reflect benchmark pricing at year-end (December), not annual averages. In limited cases, classification differences may result in minor variances when aggregating data by product type or sub-area.